Suren Fernando/@SurenFernando.

The GOSL Tabled the PortCityBill in Parliament on 8th April 2021.

1. The Bill provides for the establishment of a Commission consisting 5-7 persons appointed at the sole discretion of the President (cl.7). Such persons need not be citizens.

2. The Commission appoints the Director General (CEO) (cl.25). There is no requirement that such person be a citizen.

3. The accounts of the Commission are required to be audited by a qualified auditor (cl.15). There is no requirement that the audit be by the Auditor General.

4. Only an ‘Authorised Person’ can engage in business within the Port City (cl.26). The Commission will determine who will be so authorised…

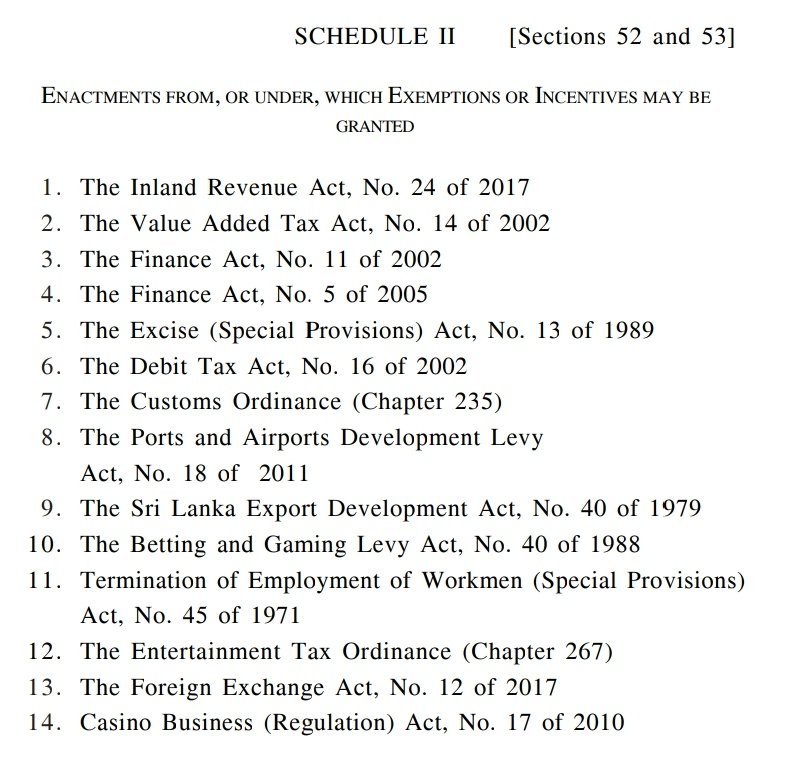

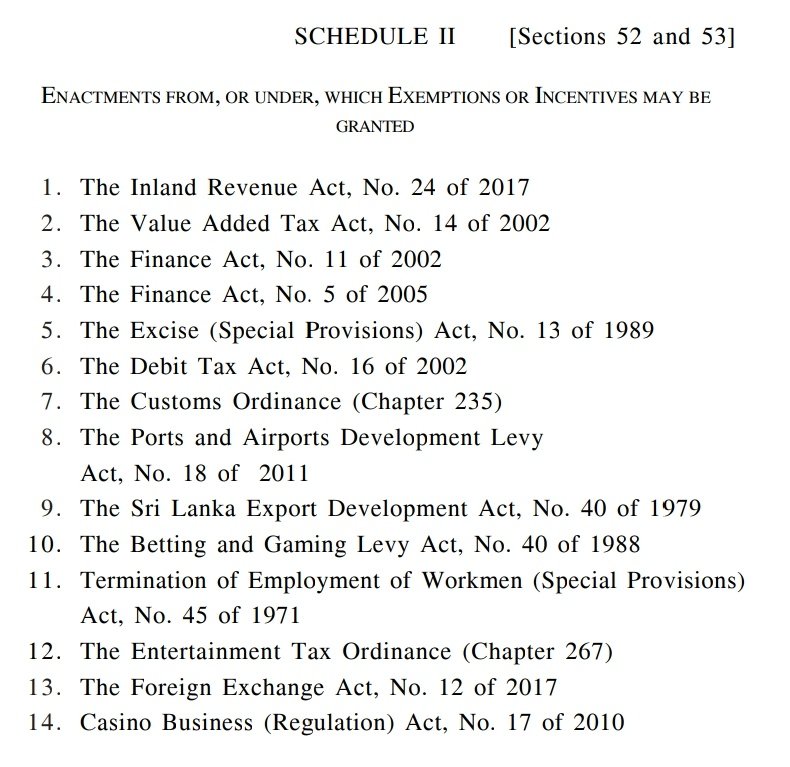

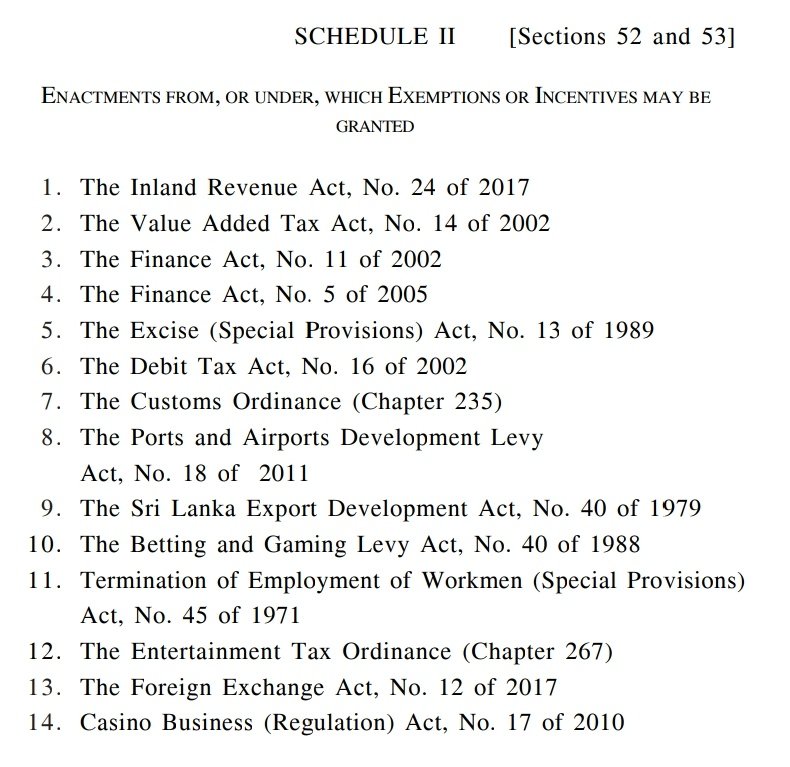

5. The Commission can exempt investors from specified laws (eg. Inland Revenue, VAT, Excise, Customs, Betting & Gaming Levy, Exchange Control, Casino Business Regulation) as per Schedule 2.

6. Applications must state the foreign direct investment which will be made (cl.27). Foreign currency deposits in local banks cannot be used for this purpose. Foreign investment can only be raised from outside Sri Lanka.

7. An Authorised Person can even be granted permission by the Commission to engage in business together with a Resident, outside the Port City (cl.37)

8. Citizens who make retail purchases within the Port City may be charged a levy in respect of same when leaving the Port City (cl.40).

9. Courts are required to give priority to cases arising within the Port City area (cl.63).

10. Where the Commission is required to obtain concurrence of a Regulatory Authority (RA), the “relevant RA… …SHALL as

soon as practicable.. …as a matter of

priority, provide such concurrence” (cl.3) thus effectively taking away the discretion of such RA.

soon as practicable.. …as a matter of

priority, provide such concurrence” (cl.3) thus effectively taking away the discretion of such RA.