Following is their full statement.

As a collective body of exporters, we have been at the forefront of sustaining employment and ensuring a steady flow of foreign exchange, even amidst the most severe economic downturns faced by our nation. Our membership covers the majority of merchandise exports, which account for some 13% of Sri Lanka’s GDP.

Today, we stand united in urging the authorities to address the pressing challenges posed by the appreciation of the Sri Lankan Rupee (LKR) against the US Dollar (USD), further compounded by restrictions on the movement of foreign currency between commercial banks, and the mandatory conversion of export earnings into Sri Lankan rupees.

Impact of rupee appreciation

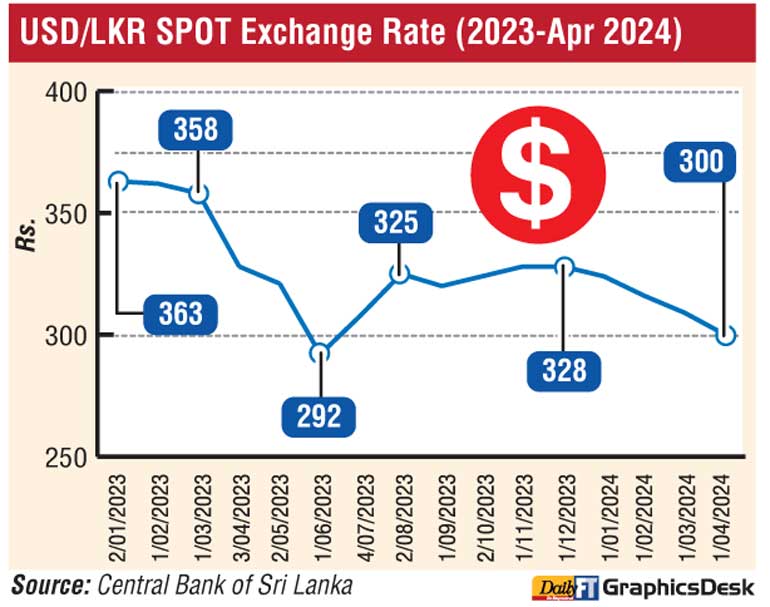

The appreciating rupee has had a multifaceted negative impact on our business. A stronger rupee means our goods become more expensive for international buyers, directly affecting our competitiveness in the global market. The exchange rate peaked at over Rs. 364 per USD in May 2022, which led to increased operational costs, compelling us to adjust our cost base in line with higher inflation experienced in the country. The rapid appreciation of the Rupee, with rates falling below Rs. 300 per USD since 19 March, has placed us in a precarious position, threatening the sustainability of our businesses and the livelihoods of those we employ. Despite the appreciation of the rupee, the cost of living remains high, continuing to level pressure on worker wages.

The timing of the rupee’s appreciation coincides with weak global demand for the majority of our merchandise exports and severe competition from competing countries. Factors such as global inflation and geopolitical tensions have continued to affect sentiment and purchasing power in the primary markets of our merchandise exports.

Background to the appreciation of the Sri Lankan rupee

The painful economic stabilisation process implemented with significant monetary and fiscal policy measures by way of policy rate, inflation, and tax adjustments; import controls; and debt service suspension, has had the desired impact to constrain economic activity and, in turn, adjust and constrain import demand. At the same time the collective efforts of the Government, export community, tourism industry and remittances have continued to have a positive inflow and enhance foreign reserve positions to more comfortable levels.

This is in the backdrop of the extraordinary circumstances when the debt servicing by the country remains at a standstill, which is a temporary situation.

During the height of the crisis, the Central Bank of Sri Lanka implemented a policy for exporters, by Gazette no.2251/42, dated 28 October 2021, to mandatorily convert foreign exchange receipts as a temporary measure. This policy enforced the conversion of all repatriated export proceeds into rupees within a stipulated time frame, except for specified exempt payments. The exporters do not have the freedom to plan the conversion as per cash flow needs or choice of bank, often forcing conversion at an overvalued exchange rate, and placing further strain on our export operations.

Revisiting policies in a changed economic landscape

It is crucial to recognise that the landscape of our foreign exchange reserves has significantly transformed and the continued enforcement of the mandatory conversion policy, considering the current positive reserves, is counterproductive. Persisting with this approach has placed exporters at a market disadvantage and forced them to operate on an uneven playing field, eroding their competitiveness. It further acts as and is viewed as an anti-export policy measure. Export-led recovery needs to be prioritised to ensure the inflow of vital export earnings and to encourage investments in the future.

Call for policy re-evaluation

In light of these considerations, we urgently request the Central Bank to revisit and repeal the aforementioned Gazette, in alignment with the evolving economic context. This appeal is made with a vision towards fostering an environment that not only enables but actively supports the growth and competitiveness of Sri Lanka’s exports. By addressing these policy concerns, we can lay the groundwork for sustainable economic development, secure employment for our citizens, and ensure the continued prosperity of our nation.

We invite the Government of Sri Lanka to join us in taking decisive action towards these ends. Together, we can chart a course towards a brighter, more resilient future for the Sri Lankan export sector and, by extension, our economy at large.