23.02.2023

Ms Sarwat Jahan

Resident Representative

IMF Representative office

Central Bank of Sri Lanka

Dear Ms Jahan,

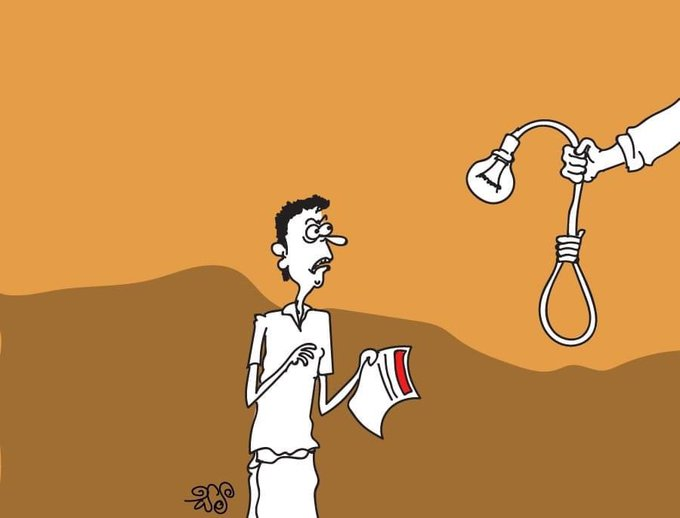

His Excellency the President has announced that the electricity tariff hike implemented from 15th February 2023 was an IMF requirement.

We welcome the implementation of cost-reflective pricing of utilities, as it is important to ensure the financial health of the Ceylon Electricity Board (CEB) as well as the overall financial system. We also note that the formula should be grounded on a reasonably robust analysis. However, on the face of it, the formula seems flawed in the computation, regressive on the distributional effects, and lacks awareness of the CEB operation. We submit our observations on the formula and other relevant information as follows.

Income and expenditure of Ceylon Electricity Board

When the electricity tariff was increased on the 10th August 2022, the CEB had an already projected annual income of 253 billion rupees in 2022. However, the tariff increase on 10th August 2022 is projected to have raised CEB’s income by 79.8% to 455 billion rupees.

With the tariff increase on the 15th of February 2023, the projected income of the CEB has increased up to 722 billion rupees, which is an increase of 285% from February 2022. Due to this price hike, the consumer is subject to an approximately three-fold increase in tariffs.

The total generation of electricity in Sri Lanka was 15,865 GWh in 2022. The total consumption for the same year was 14,415 GWh and therefore 1,450 GWhs (9.5%) of the power generated were wasted. The unserved portion of energy due to power cuts was 798 GWhs which is 5% of the generated amount.

CEB’s total income was 332.1 billion rupees in 2022. The total expenses were 470.9 billion rupees. This included a financing cost of 38.1 billion rupees, which is not an expense incurred due to the direct operations of the CEB. The depreciation cost was 33.1 billion rupees, which was also not a direct operational or cash flow-related cost. The sum of direct generation costs (CEB fuel, CEB coal, IPP, NCRE) was 315.1 billion rupees, which was approximately 79% of the direct operations cost.

While keeping these facts in mind, we draw your attention to the following clauses included in the press release of the staff-level agreement between the government of Sri Lanka and the IMF on 1st September 2022.

i. “Introducing cost-recovery-based pricing for fuel and electricity to minimize fiscal risks from state-owned enterprises. The team welcomed the authorities already announced substantial revenue measures and energy pricing reforms”.

ii. “Mitigating the impact of the current crisis on the poor and vulnerable by raising social spending and improving the coverage and targeting of the social safety net program”.

iii. “Reducing corruption vulnerabilities through improving fiscal transparency and public financial management”

We think that the tariff hike of CEB needs to be evaluated based on these published intentions of the IMF.

Is the CEB tariff hike reasonable?

We raise the question as to how reasonable it is to project that the total expenses of CEB would be 722 billion rupees in 2023 when it was only 470.9 billion rupees in 2022. Power cuts saved 5% of generated electricity in 2022 (while the economic impact of these power cuts on the economy was much larger). The forecast for 2023 is expected to be a 4% reduction in electricity demand due to the contraction in the economy. The savings from the reduced demand alone would be sufficient for an uninterrupted power supply, on the basis of the comparative cost in 2022. Further, the demand for electricity is not linearly proportionate to the cost of generation. The marginal unit cost will rise exponentially from hydropower to other sources such as renewable energy, coal, furnace oil, naphtha, and diesel. On the other hand, fuel and coal prices have come down at least by about 35% from the peak observed in 2022. It is difficult to understand the reasons for the prices of fuel and coal not declining in Sri Lanka, despite the considerably low world market prices in February 2023 compared to May 2022.

The following table illustrates how unreasonable the tariff hike by CEB is.

Impact on the poor

The percentage below the poverty line in Sri Lanka was estimated to be 12.5% in 2021. It rose to 26% in 2022 and is expected to rise further in 2023 according to the World Bank. The new objective criteria to recognize the poor, defined as households with less than 60 units of electricity consumption has identified a 3.2 million population below the poverty line. Is it justifiable to increase the electricity tariff by 250% for this poor population? An equivalent amount to the Samurdi compensation which is given to the poor is being extracted (squeezed) out from the poor through this tariff hike.

Further, the cost of the construction of hydropower plants has already been borne (paid) by the citizens, including the poor of this country. Technically the power generated by hydroelectricity is used for frequency controlling, while the electricity consumption of the poor does not include the electricity generated through high-cost fuel generators. It is reiterated that the marginal cost increases when the total power consumption of the economy increases. Therefore, it may not be technically accurate to charge the poor in this manner. (Hydropower 33.8% – 5366 GWh in 2022. Less than 60 units of household consumption was 7% of the total consumption)

Inefficiencies of CEB

_

It is surprising that IMF has not imposed any conditionality on the performance of CEB. Simply, the IMF appears to be ignoring the significance of curtailing expenses at CEB. Instead, it is attempting to meet an inflated cost via tariff hikes, burdening the poor and vulnerable. This would also adversely impact the relative competitiveness of Sri Lanka’s economy. To avoid a distorted pricing structure where inefficiencies of CEB passed on to the consumer, we suggest the IMF to focus on the following as well:

• Reducing the 9% energy loss/wastage of electricity at CEB

• Demand management of electricity

• Financial discipline at CEB

• Quality service with minimum breakdown

• Service efficiency and the efficiency of power plants.

A strong allegation made by the trade unions against these tariff hikes is that the current measures are implemented with the intention of unbundling CEB by showing an artificial “profit” via the tariff hike. In our view, unbundling is not a panacea for the deep-rooted problems in the energy sector.

Irregularities in the procurement procedure.

There are allegations that the fuel and coal prices at procurement are considerably higher than the world price. The Auditor General’s report on the procurement of coal for 2022 – 2025 which was tabled at the COPE committee clearly highlights these irregularities. We are unable to comprehend why the IMF is silent about these irregularities in the procurement process of CEB.

Conclusion

We reiterate our support for the cost-reflective pricing of utilities. However, we also strongly recommend carrying out an in-depth analysis to understand the full picture of the sector rather than relying on haphazardly designed quick fixes, which can have medium to long-term adverse implications.

Broadly, attempting to reconcile the numbers at the treasury, the central bank, the state banks, CEB, and CPC as individual units without considering their interconnectedness could undermine the financial stability of these individual entities as well as the overall health of the financial system. On the other hand, it is important to keep in mind that without the cooperation of the public and the trade unions, no restructuring or re-organization could become successful.

We kindly request the IMF to confirm whether the current formula is: (i) a requirement of the IMF program, and (ii) in conformity with the IMF expectations.

Look forward to engaging if the IMF decides to carry out broader consultations with stakeholders to design appropriate policies to bring Sri Lanka to a sustainable path.