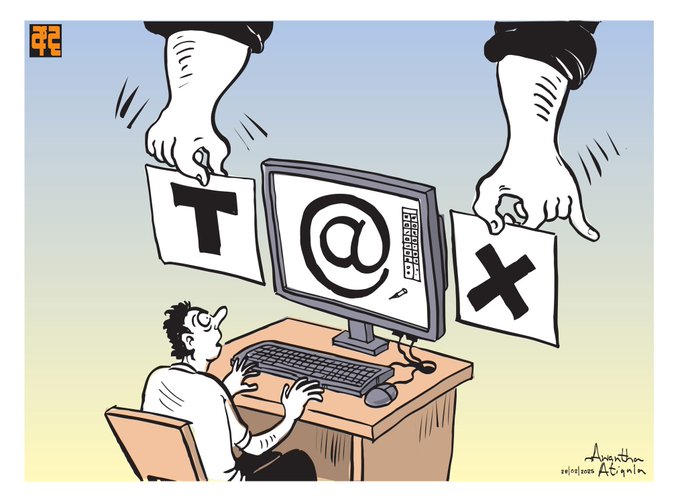

In the 2025 Budget, the income tax exemption has been removed for export services which aligns with global digital taxation practices and aims to increase government revenue, Finance Ministry sources said.

Minister of Labour Anil Jayantha said digital service providers will be exempt from income tax on the first Rs.150,000, with a 6 per cent tax on the next Rs.85,000 and a maximum 15 per cent on other income.

In Sri Lanka, annual Inland Revenue amendments following budget proposals have historically provided exemptions for individuals and corporations earning foreign currency through services rendered to clients abroad, provided the earnings are remitted through the local banking system. This policy aims to encourage the inflow of foreign currency and support the export of services.

Aa tax expert said the government needs to get more tax revenue and the move was part of this process.

However a former Treasury Secretary said this sudden change will exert unnecessary shock which cannot be prevented from buffers as the impact of this new tax on online freelancers is significant, adding that the normal service export revenue of over US$3 billion may be affected.

Besides, this change would impact the competitiveness of the Sri Lankan freelancers in the international market since they may be compelled to adjust their prices suddenly in an effort to finance the new taxation.

IT freelancers and service exporters are among the foreign exchange earners for the country and imposing taxes suddenly would frustrate them and prompt them to leave the country.

By Bandula Sirimanna – Sunday Times