(Statement) We were invited to Sri Lanka between 9-11 June 2024, where we participated in consultations in Colombo with academics, researchers, activists and political parties.

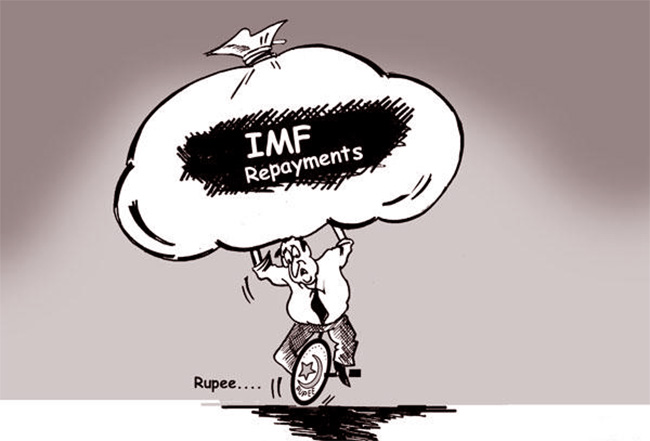

We do not believe that the current economic policy program defined in the 17th Agreement with the International Monetary Fund (IMF) provides a sustainable path of recovery for Sri Lanka or a credible means of resolving its external debt crisis. This is based on our analysis of the factors leading to the economic collapse, our assessment of the agreement and the policy package that accompanies it, and our estimation of the economic, social, and political burdens of fiscal consolidation under the current program. As political parties prepare for the upcoming Presidential and parliamentary elections, it is in the best interests of the Sri Lankan people that all actors commit to renegotiating the terms and conditions of the Extended Fund Facility (EFF) with the IMF. The need for such renegotiation arises from the following.

- The program does not emphasise the urgency and relevance of countercyclical measures to stimulate employment and livelihoods while ensuring the basic needs of the people including education, health, and social protection.

- The economic growth targets in the program are excessively optimistic, and do not recognise the adverse impact that the fiscal measures embedded in the program would have on economic activity.

- This is turn means that the targets for a primary budget surplus, external debt servicing, gross financing needs and the public debt to GDP ratio are overly optimistic and unlikely to be met despite the very severe squeeze on the living standards of ordinary people.

- The benchmarks and the quantitative goals take no account of structural conditions leading to Sri Lanka’s crisis or the global instability that will inevitably also affect Sri Lanka.

- There is lack of sense in the methodology of the IMF’s debt sustainability analysis (DSA). The estimates of needed external debt reduction are extremely low. This is sought to be concealed by a diversionary inclusion of domestic debt in the restructuring process, and an emphasis on “gross” financing rather than external financing needs. While domestic debt restructuring will not yield any foreign exchange to address the external debt crisis, it imposes burdens on the working people, by imposing haircuts on sovereign debt held by pension funds that are the repositories of the savings of workers. This should be reversed. In addition, the crucial problem of repaying foreign debt is underplayed, resulting in low haircuts from foreign creditors who lent at high interest rates that included a risk premium, which are unlikely to deliver the relief that is essential. Indeed there is likely to be little change in the total external debt. So, debt restructuring must focus on foreign exchange-denominated debt.

- The benchmarks for economic reform and the austerity conditionalities in the IMF program impose a large burden of adjustment on the poor and vulnerable sections of society, which have already been severely hit by the crisis. The increase in indirect taxation is regressive, as the poor pay a disproportionately higher share of incomes than the rich. The increase in energy tariffs on electricity, cooking gas, and kerosene has increased the burden on working households in both urban and rural areas. Austerity policies have already led to electricity disconnection of one million households; falling school attendance; unemployment and under-employment. The devastating impact of such measures is largely borne by women and children in these households.

- The legislative drive to take policy measures from a flawed agreement and convert them into binding laws through the Economic Transformation Bill, is detrimental and dangerous. It is an attack on democratic norms and the system, intended to tie to the hands of the incoming Government, irrespective of the mandate it receives from the people. The Parliamentary approval of the program should have been sought before the deal between the Sri Lanka’s Government and the IMF Staff was approved by the IMF Executive Board, not afterwards. On the verge of an election, the untimely approval of a Program already in place should not be seen as proof that the IMF Exceptional Access Criterion #4, “Ownership”, is met.

- Such legislation is also oblivious to future developments both external and internal that could require a change of policy. If such legislation is passed now, future governments seeking to change it could face investor-state-dispute-settlement cases brought under different Bilateral Investment Treaties that Sri Lanka is a signatory to.

Overall, there should be a change of orientation in dealings with the IMF and Sri Lanka’s creditors. The aim must be to protect the living standards of the people and to promote the growth of the economy in ways that expand incomes, create good-quality jobs, and improve the trade balance. This means that the debt restructuring process has to be based on ensuring that the debt stock does not increase with interest payments; on a haircut on commercial debt that is far more than 30%; on multilateral and bilateral agencies also accepting a reduction of their contribution to the debt stock.

The next Government should undertake that all future borrowing in foreign currency and under foreign law, or from the IMF, has to be scrutinised and approved by Parliament. Any prospective loan agreement should be disclosed to the public with adequate time for discussion. In renegotiating its current agreement with the IMF, a starting point is for Sri Lanka to embark on its own debt sustainability analysis, based on an open and consultative process. A minimum condition for any progressive and humane way out of this crisis is that the democratic space for citizens must be defended and extended.

(Martin Guzman is a Professor, Columbia University, New York, USA and former Minister of the Economy, Republic of Argentina; Charles Abugre, Executive Director, International Development Economics Associates, (IDEAs); Jayati Ghosh, Professor of Economics, University of Massachusetts Amherst, USA and former Professor, Jawaharlal Nehru) University, New Delhi, India; and C.P. Chandrasekhar, Director of Research, International Development Economics Associates (IDEAs) and former Professor, Jawaharlal Nehru University, New Delhi, India.