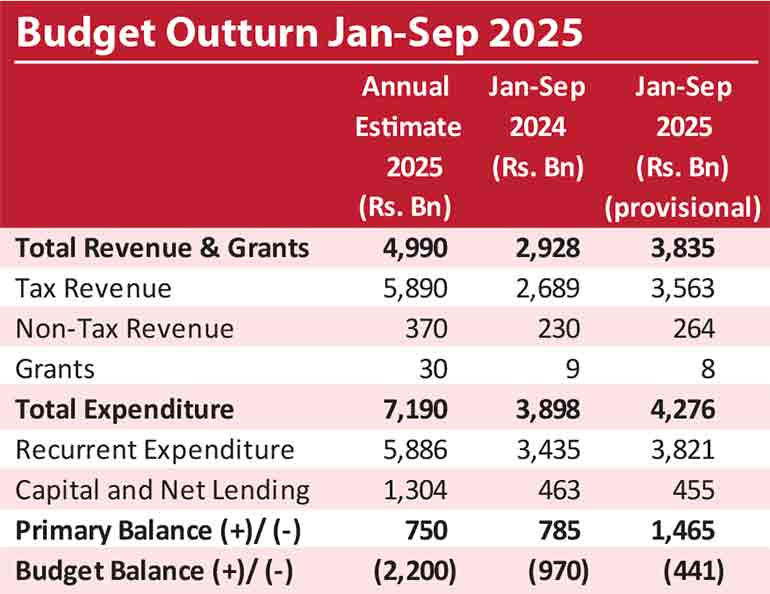

- Deficit down 54.5% YoY to Rs. 441.4 b in Jan.-Sept 2025 from Rs. 970 b

- a year ago; primary account surplus doubles YoY to Rs. 1.4 t

- Revenue up 31% YoY to Rs. 3.83 t, led by VAT and import taxes; Customs collects Rs. 1.7 t, meeting 80% of its annual target

- Expenditure rises 10% YoY to Rs. 4.3 t, driven by recurrent spending

- Capital spending dips 2% YoY to Rs. 455 b as interest costs climb

(Daily FT/October 29,2025)

Sri Lanka’s fiscal performance continued to strengthen, with the Budget deficit more than halving in the first nine months of 2025, according to the Finance Ministry’s latest Fiscal Review Report.

The deficit fell 54.5% year-on-year (YoY) to Rs. 441.4 billion in the first nine months of 2025 from Rs. 970 billion a year earlier, mainly due to higher revenue collections, which grew 31% YoY to Rs. 3.83 trillion from Rs. 2.93 trillion. The primary account surplus more than doubled to Rs. 1.4 trillion.

Income tax revenue rose 12% to Rs. 831 billion, while VAT brought in Rs. 1.24 trillion, up 31% from a year earlier. Customs accounted for nearly half of total tax receipts, collecting Rs. 1.7 trillion and achieving 80% of its annual target.

The Inland Revenue Department contributed Rs. 1.64 trillion, reaching 75% of its estimate, while the Excise Department collected Rs. 168 billion, or 70% of its goal.

Revenue from import VAT climbed 42% to Rs. 605 billion, while excise duties almost doubled to Rs. 552 billion.

On the expenditure side, total spending rose 10% to Rs. 4.3 trillion, driven by a rise in recurrent expenditure to Rs. 3.8 trillion.

Capital spending and net lending declined 2% to Rs. 455 billion, while interest payments increased 8.6% to Rs. 1.9 trillion.

The International Monetary Fund (IMF) in its last review earlier this month noted the Government’s improving fiscal performance, but there was a lot more to be done.

The release of the next tranche under Sri Lanka’s $ 3 billion Extended Fund Facility (EFF) will depend on Parliament approving a 2026 Budget aligned with the program’s fiscal and debt sustainability goals.

The IMF said that the 2026 Budget should be in line with program parameters to continue building fiscal space on the back of strong revenue measures and prudent spending execution.

It noted that improving tax compliance, broadening the tax base, and addressing revenue leakages remain key to sustaining fiscal progress, while efficient spending and stronger public financial management will help preserve fiscal discipline.

Debt restructuring is nearing completion, the IMF said, adding that sustained reform momentum, particularly in public finance, State enterprise governance, and anti-corruption measures, will be critical to maintaining stability and investor confidence.

Govt. earns Rs. 349 b from vehicle imports in first nine months

- Vehicle import tax revenue surges 818% YoY

Vehicle import duties surged 818% year-on-year to Rs. 349 billion in the first nine months of 2025, up from just Rs. 38 billion a year ago, according to the Finance Ministry’s latest Fiscal Review Report.

According to CBSL data released in September 2025, vehicle imports reached $ 193 million in July, boosting the total to $ 668 million for the first seven months of the year.

Govt. earns…

The value of motor vehicle imports is expected to reach $ 1.5 billion this year, up from the earlier projection of $ 1.2 billion, Central Bank Governor Dr. Nandalal Weerasinghe said last week.

This means the Governor expects vehicle imports to total $ 830 million in the last five months of 2025.

Earlier this month the International Monetary Fund (IMF) noted that the Government’s fiscal performance has been strong, primarily supported by taxes on motor vehicle imports.

But the revenue boost from vehicle import taxes is seen as temporary and not a structural improvement in Sri Lanka’s revenue administration.