|

| We voted against the Bill stating that the Bill was unconstitutional |

”After the end of the Second reading prior to the vote being taken in Parliament, I sought clarification from the Speaker as to the basis on which he was calling for the vote as we were to vote on a Bill that had been declared unconstitutional. I also wanted to know whether the government was proposing to amend the Bill. If so, the details of the Amendments should be presented to Parliament. After some debate, the Speaker proceeded with the vote on the basis that the Bill will be amended at Committee Stage.

We voted against the Bill stating that the Bill was unconstitutional. ”

Eran Wickremaratne M.P.

Annually the Government presents to Parliament its income and expenditure statement, and how it intends to finance the deficit between income and expenditure. With the exception of a couple of years since independence in 1948, the Government Budget has been in deficit.

The Budget process begins when the Government presents an Appropriation Bill in Parliament, followed a month or so later by a speech in Parliament known as the Budget Speech made by the Finance Minister. The Budget Speech contains proposals for raising revenue through taxation. On completion of the Budget Speech the Budget debate begins.

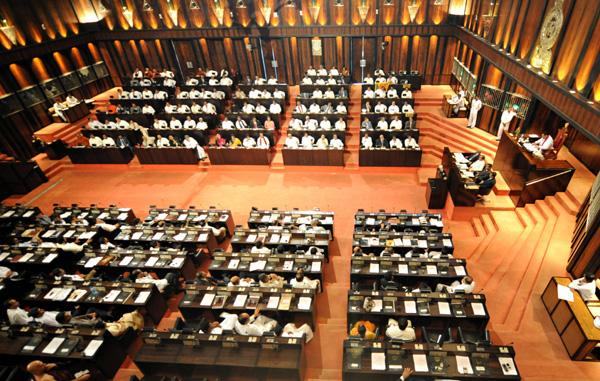

The tabling of the Appropriation Bill is known as the First Reading, while the debate that follows the Budget Speech is known as the Second Reading. During the Second Reading the debate takes the nature of a plenary session of Parliament where members focus largely on the macro-economic philosophy, economic strategy, plans and direction, income, expenditures, cash flows, debt, savings, investments, economic growth, employment, trade, exchange rates, reserves and so on. At the end of about a week’s debate, a vote is taken. Then the Budget debate takes on the form of a Committee discussion for about two weeks.

For the most part, the whole of Parliament sits as a Committee debating the financials and workings of Ministries. Each day a vote on the debated Ministry is taken. At the conclusion of the Committee Stage, Parliament meets in a plenary session and votes on the Budget. It is only then that government funds can be utilised for different expenditures. The people through their representatives vote to collect taxes and also how those taxes can be utilised. Citizens also approve how the excessive expenditure being incurred could be financed through borrowings.

Appropriation Bill Unconstitutional

After the Appropriation Bill was tabled in Parliament, it was challenged in Court for its inconsistency with the Constitution. A Bench comprising Justices Shiranee Tillakawardane, Priyasath Dep and Eva Wanasundara determined that Clause 2(1) (b) and 7 (b) of the Appropriation Bill were inconsistent with the Constitution.

Counsel agreed with Court that the inalienable sovereignty of the people must be exercised by Parliament under the doctrine of public trust in terms of Article 4 (a) of the Constitution. The Court emphasised that proper fiscal accountability is the bedrock of good governance. Attention was drawn to the fact that dominant control of Public Finance by Parliament is enshrined in Article 148, including the control of the source of finance.

The Court ruled that Parliament’s approval of a borrowing limit as specified in the Appropriation Bill and the lack of Parliamentary supervision, scrutiny and control of the terms of the loan, interest payments or the period of payment, was tantamount to the abdication of the power of control over fiscal matters. When the case was made that such information would be available subsequent to the contracting of the loan, the argument was rejected by Court.

The Judgment read, “This anomaly could be rectified if the impugned clause is amended to read, that prior to obtaining the loan, the terms of such loan must be approved by Parliament. If not this Court is of the view that Clause 2 (1) (b) would be unconstitutional as under its scheme, Parliament will fail to exercise the due and full financial control envisaged under Article 148…”

Clause 7(b) permits the Minister to withdraw sums allocated for a specific purpose and/or from the Consolidated Fund, at his will, with no controls. The clause has no limitations, nor does it require the sanction of Parliament. The Court determined that to allow the clause to remain as it is, will obstruct full Parliamentary fiscal control at the macro level. The Court found no justification in giving unilateral decision making to the Finance Minister over public finances outside Parliamentary control.

The principle enunciated in the 1986 Determination states, “It would be anomalous for Parliament which has to exercise financial control over expenditure by the Executive to delegate that power to the very authority which it has to supervise without devising suitable checks to control the use of that power.”

It was the view of Court that the Finance Minister could not be given such unfettered power to vary the Appropriation Bill or its Schedules. The Court’s suggested cure was to amend the Bill to read that it could be done only with Parliamentary approval. Therefore Clause 7(b) was also declared inconsistent with the Constitution.

The Court had previously stated that Parliament is not expected to micro manage the finances of government, and states that this is not the spirit of the Constitution. So the Court’s restrictions on Clause 2(1) (b) and 7 (b) were after taking note of concepts and practical realities.

Point of order

After the end of the Second reading prior to the vote being taken in Parliament, I sought clarification from the Speaker as to the basis on which he was calling for the vote as we were to vote on a Bill that had been declared unconstitutional. I also wanted to know whether the government was proposing to amend the Bill. If so, the details of the Amendments should be presented to Parliament. After some debate, the Speaker proceeded with the vote on the basis that the Bill will be amended at Committee Stage.

We voted against the Bill stating that the Bill was unconstitutional.

Prior to the Final Vote on 8 December the Government presented amendments to the Bill. The amendments enabled the reporting of details of loans taken and also details regarding shifting of expenditures from one category of expenditure to another. This was to be done through the Final Budget Position Report which is required to be tabled in Parliament under Section 13 of the Fiscal Management (Responsibility) Act No. 3 of 2003. The Amendment did not address the Supreme Court’s requirement that prior approval of Parliament was required. The Government as usual was not in a mood to compromise on its pre-determined course of action, irrespective of the fact that it violates a determination of the Supreme Court.

The possible way forward on the amendment was to provide for a broad term sheet on borrowings to have prior approval of Parliament and to restrict the Finance Minister’s discretion so that Parliament retained “some amount of actual and direct control however nominal” as was stated in the 1986 determination. An amendment could have also been worked out where any change in expenditures could have had the prior approval of the Cabinet of Ministers rather than the Minister. If the Government and the Judiciary worked in harmony such an amendment could have been referred to the Supreme Bench for concurrence or further amendment. However, that was not to be.

The making of a Constitutional crisis

The Speaker ruled that he had been advised by the Attorney General that the Amendment was in order if a special majority in Parliament could be obtained. The Supreme Court had not suggested such a remedy in its determination. The Government’s modus operandi is to push through unconstitutional Bills such as Divi Neguma, the Appropriation Bill, and controversial and unjust processes as seen in the impeachment process of the Chief Justice, utilising its two-thirds majority in Parliament.

The Government fails to understand that it has no two-thirds majority mandate given by the voter but an artificial majority created by crossovers in the House of Parliament. Many cases are pending in the courts against such crossover Members of Parliament. It is yet to be determined whether these Members of Parliament should be unseated for violating the sovereignty of the voters. A government which enjoys such majority on an artificial basis, where court is yet to determine the validity of such crossover, is attempting to change not only a flawed Constitution but the very nature of the state by devious parliamentary manoeuvres.

The refuge of the citizen is in the fact that Article 120 of the Constitution states that the Supreme Court shall have sole and exclusive jurisdiction to determine whether any Bill or any provision thereof is inconsistent with the Constitution. By violating the determination of the Supreme Court the Government is creating a Constitutional

-FT