(Sri Lanka Brief/ 13 November 2025)

This question has resurfaced as several state-owned enterprises continue to incur heavy losses, raising concerns about whether government involvement should be limited to national security and essential services.

Current Financial Situation

- 18 out of 52 major state enterprises are loss-making, according to the Ministry of Finance mid-year report (2025).

- These losses require significant taxpayer funding, adding pressure on public finances.

- Overall profits of state enterprises dropped from Rs. 280.7 billion (first half of 2024) to Rs. 227.8 billion (first half of 2025).

Major Loss-Making Enterprises

- Ceylon Electricity Board (CEB)

- Pre-tax loss (Jan–Jun 2025): Rs. 13.2 billion

- Compared to a profit of Rs. 119.2 billion in the same period of 2024.

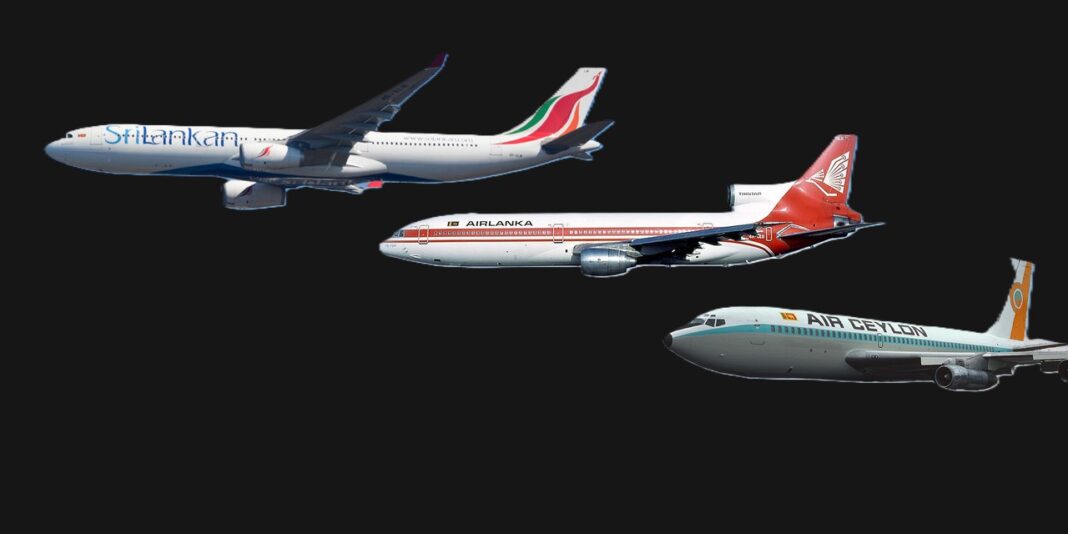

- SriLankan Airlines

- Pre-tax loss (Apr–Jun 2025): Rs. 12 billion

- Accumulated losses: Rs. 628.3 billion

- Negative equity: Rs. 415.2 billion

- Total liabilities: Rs. 606.7 billion

- Cabinet approved restructuring of long-term debt (US$210 million + Rs. 31.4 billion).

- Experts argue mismanagement and political interference are key issues.

- Lanka Sugar Company Limited

- Pre-tax loss (Jan–Jun 2025): Rs. 2.6 billion

- Loss in 2024: Rs. 1.9 billion

- Profit in 2023: Rs. 2.8 billion

Other Loss-Making Institutions

Includes Lanka Sathosa, State Engineering Corporation, Rupavahini Corporation, ITN, State Timber Corporation, Fisheries Corporations, and several plantation boards.

Additional Concerns

- 10 institutions cannot pay EPF/ETF or taxes, requiring government intervention of Rs. 11 billion (Rs. 5 billion allocated in 2026 budget).

- Recruitment often driven by political patronage rather than financial discipline.

Profit-Making Enterprises

- State banks increased profits by Rs. 65.5 billion.

- Ports Authority, Water Board, and Insurance Corporation also reported gains.

- Airports and Aviation Services grew assets by 9.3% (Rs. 243 billion).

Government’s Next Steps

- Close down 33 inactive institutions.

- Merge entities with overlapping functions.

- Restructure outdated objectives.

- IMF recommends restructuring SriLankan Airlines.

Key Takeaway

Loss-making state enterprises are draining public funds due to poor management and political interference. The government plans closures, mergers, and restructuring to reduce this burden.

(With the inputs from BBC Sinhala site)