Cartoon from Weekend FT.

- IMF’s EFF insufficient to resolve SL’s chronic and acute forex problems

- EFF will help Sri Lanka rebuild lost confidence among foreign investors

- Act very fast in getting all creditors to agree on a common programme

- SL must introduce mechanism to hold economic criminals accountable

- Unfortunate that IMF has to tell SL to have a proper governance system

- SL should now welcome proposal for governance diagnostic exercise

The news of the IMF Executive Board approving $ 3 billion under the EFF arrangement for Sri Lanka earlier in the week was widely welcomed. What does this facility really mean for Sri Lanka, what are the immediate changes it will bring about, and how will the months ahead play out?

This $ 3 billion which Sri Lanka is to receive under the EFF over four years in eight instalments is insufficient to resolve its chronic and acute foreign exchange problems, but it will help Sri Lanka to rebuild the lost confidence among foreign investors and tap their funding inflows regularly, because now the Ranil Wickremesinghe administration is under the disciplinary control of the IMF.

It also provides breathing space for the Government to design and implement a viable economic recovery programme to put the real economy back on the long-term growth path. So, in the months ahead, Sri Lanka will have to do a lot to consolidate the gains from this facility and anchor it to its long-term growth strategies involving making the country a rich country by 2048.

According to the IMF, the objectives of the EFF-supported programme are to restore macroeconomic stability and debt sustainability, safeguard financial stability, and step up structural reforms to unlock Sri Lanka’s growth potential, while being mindful of the need to protect the most vulnerable and improve governance. How should Sri Lanka work towards realising these objectives?

The IMF facility is simply a financial arrangement to address the country’s financial sector issues. But to consolidate its gains, the Government should work on an agreed programme with the IMF to tame the budget, bring inflation under control, and make the exchange rate flexible to be determined by market forces. These are necessary but not sufficient for Sri Lanka to attain its final goal of delivering prosperity to people through the development of the economy on a sustainable basis.

The reforms to be introduced for this purpose will worsen the living conditions of people at the low level of incomes. Hence, it is necessary to give them a hand through a safety net arrangement in the form of a cash grant. But all these good things which are being implemented will be wasted unless there is a good governance structure. That is why the programme is linked to goals such as protecting the poor, improving the governance structure, and eliminating bribery and corruption through a concrete plan.

But these are things which Sri Lanka should do on its own with or without the IMF. It is unfortunate that the IMF will have to come and tell our political leaders of the need for these essential institutional arrangements.

What would you list as key priorities for the Government as it looks to ensure economic recovery?

The most important priority is to go along with the programme which the Government has agreed with the IMF over the next four years till 2028. But the commitment does not end there and it will be extended to 2032 when the final instalment of the repayment of the EFF facility is made by Sri Lanka.

This programme requires the Government to tighten its belt drastically with respect to its expenditure and borrowing. Under the programme, the Government cannot borrow any more from the Central Bank, which is to be given greater autonomy after the new Central Bank Law is enacted.

There are some compromising provisions in the law where the minister of finance is empowered to nominate the governor, governing board members, and the two members to the Monetary Policy Board and appoint the deputy governors of the bank. If these provisions are not changed at the committee stage, permitting a selection process for these high officers of the Central Bank, it is essential that the minister does his job of nominating and appointing, as the case may be, by following a transparent procedure in line with global best practices. Appointing those who are loyal to him or the Government to these high positions will not only compromise the autonomy of the Central Bank but also reverse the existing provisions relating to the autonomy of the bank.

The Government is required to generate a surplus in the primary account of the budget from 2024 onwards. Primary account balance is the difference between the total revenue of the Government and the total expenditure except the interest payments. Two approaches should be adopted by the Government to reach this target. One is the increase in revenue. The other is the curtailment of expenditure except interest expenditures.

Since it is inadvisable to curtail capital expenditure, what the Government should cut are day-to-day consumption expenses. This is a severe constraint for the Government during the programme period. This should be well understood by ministers, parliamentarians, and top policymakers of the Government as a limit on the expenses they must incur.

Another priority is the finalisation of the rescheduling of the bilateral and commercial loans. For this purpose, the Paris Club should meet and decide on the model of accepting a haircut in the principal or the interest or both.

President Ranil Wickremesinghe had informed the Paris Club creditors that Sri Lanka will be transparent in this exercise, will not pay any creditor without informing them, and will not give any preferential treatment to any creditor. What this means is that China, which had earlier offered only a two-year debt moratorium to Sri Lanka, will now have to fall in line with the decisions taken by the Paris Club. If it is a haircut that is decided, Sri Lanka will not offer a better proposition to China. This will be a gigantic task for the Government.

What approach would you recommend in working with Sri Lanka’s creditors in terms of debt restructuring?

Sri Lanka should act very fast in this case in getting all the creditors to agree on a common programme. Since the promise given to Paris Club creditors is that all will be treated equally and no creditor will be given a preferential treatment, the holdout creditors like China should be brought on board to agree to the common rescheduling programme. Then, Sri Lanka should get the commercial creditors too to agree to the same.

According to the report filed by the IMF staff with the Executive Board of the fund, Sri Lanka will get $ 3.75 billion from the World Bank, Asian Development Bank (ADB), and friendly bilateral creditors over the programme period from 2023 to 2027. This is the already-promised amount by these creditors.

Do you see the EFF approval leading to financial support from other development partners?

Yes. According to the report filed by the IMF staff with the Executive Board of the fund, Sri Lanka will get $ 3.75 billion from the World Bank, Asian Development Bank (ADB), and friendly bilateral creditors over the programme period from 2023 to 2027. This is the already-promised amount by these creditors.

This is substantially lower than the amount quoted by the Presidential Media Division that the country will have access to $ 7 billion after the approval of the EFF. If the President is sure that Sri Lanka will get an additional amount from another source, he should activate it immediately and get it for the benefit of the country.

Does this Government have the will to push through the necessary reforms to ensure recovery and stability?

In the last year or so, the Government had met 14 preconditions for securing this facility from the IMF. These are some unpopular tasks like increasing taxes, revising tariffs on electricity and fuel to reflect costs, and increasing interest rates. Since there is no other choice available to the Government, it will have to continue with the other reforms too.

How feasible is the strengthening of social safety nets under the current circumstances? How can the protection of the most vulnerable be ensured?

This is one of the conditions of the programme. Already action has been taken by the Government to digitise the delivery of these funds to deserving people. Since the Government does not have money for this purpose, a credit line may be negotiated with the World Bank and ADB to secure funding.

Do you see the Government sticking to its guns on the tax reforms? Are there any changes you would recommend to the current tax regime?

According to the agreed programme with the IMF, the Government has promised to tame the budget by increasing the revenue, known as revenue-based fiscal consolidation. Under this, one of the targets Sri Lanka should meet is increasing tax collection.

Since the tax reforms introduced on 30 May 2022 were insufficient to generate the promised surplus in the primary account of the budget, the new tax regime which was additional and more ambitious was introduced from January 2023. In the letter which the President and the Governor of the Central Bank had addressed to the IMF jointly, the Government’s position of maintaining that tax regime has been reiterated. Therefore, the Government will stick to this new tax reform.

How can the stability of the financial sector and confidence in the banking system be ensured?

As a part of the conditions for the EFF facility, the Central Bank has hired two experts from outside to make an assessment of the quality of the assets of the systemically important banks in the country. This is important because, with the increase in the interest rates, the market value of the securities held by banks had fallen drastically, generating unrealised losses. When these losses are charged to the profit and loss accounts, there will be an erosion of the capital base of these banks.

If the proposed assessment reveals such a capital erosion, it is necessary to recapitalise the banks concerned as quickly as possible. This will help the system to win the trust and confidence of the public.

What steps do you recommend in tackling corruption and ensuring accountability?

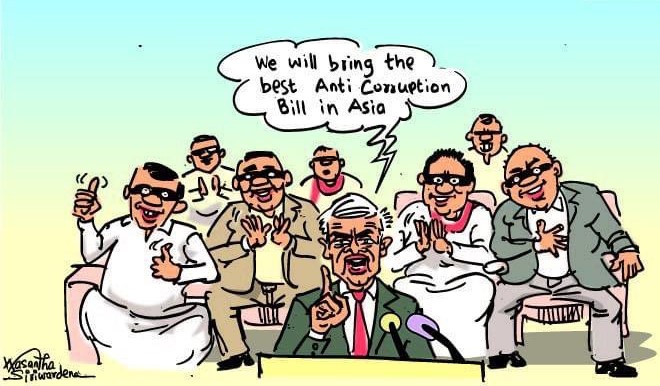

The programme has made it mandatory for the Sri Lankan Government to introduce a new anti-corruption mechanism in line with best global practices. It has been announced by the President that a draft bill is under preparation for this purpose.

One of the novelties in the new mechanism is that the anti-corruption authority can investigate any corrupt practice on its own without waiting for a complaint from the public. Another feature is the introduction of an asset recovery system when the money stolen has been taken out of the country and parked elsewhere.

What are the safeguards that should be put in place to ensure policy missteps with far-reaching repercussions do not occur once again?

There has not been such a system proposed in the present programme. However, since Sri Lanka has already gone through an episode of irresponsible policymaking leading to irreversible economic costs, it is necessary for the country to introduce an effective mechanism to hold those who have committed such economic crimes accountable.

One is the promotion of public interest litigation under which the cases should be heard and judgements should be delivered without delay. Another is to have a permanent economic crimes commission to handle such cases.

The IMF in its statement said Sri Lanka would be the first country in Asia to undergo a governance diagnostic exercise by the IMF. What does this mean for Sri Lanka?

It is unfortunate that the IMF has to tell Sri Lanka that the country should have a proper governance system. It is something which Sri Lanka should have done on its own. However, now the country should welcome the proposal to conduct a governance diagnostic exercise.

This is very important for Sri Lanka because it will establish proper governance at the Central Bank, Ministry of Finance, and other relevant Government institutions. It is also a step taken to eliminate corruption.